[Previous entry: "April Hardyville Column -- Greed, Envy, and Other-People's-Business Minding"] [Main Index] [Next entry: "Bruce Schneier announces the Movie-Plot Threat Contest"]

04/01/2006 Archived Entry: "Performance of the Real IRA"

THE PERFORMANCE OF THE REAL IRA

There's only 2 weeks left to make this year's IRA contribution - unless you use the REAL IRA. Then you can contribute any time. There are no contribution limits, no "required distributions," no forms to fill out, no taxes to pay, and no penalties for early withdrawal.

But cautious savers want to know how one plan stacks up against another.

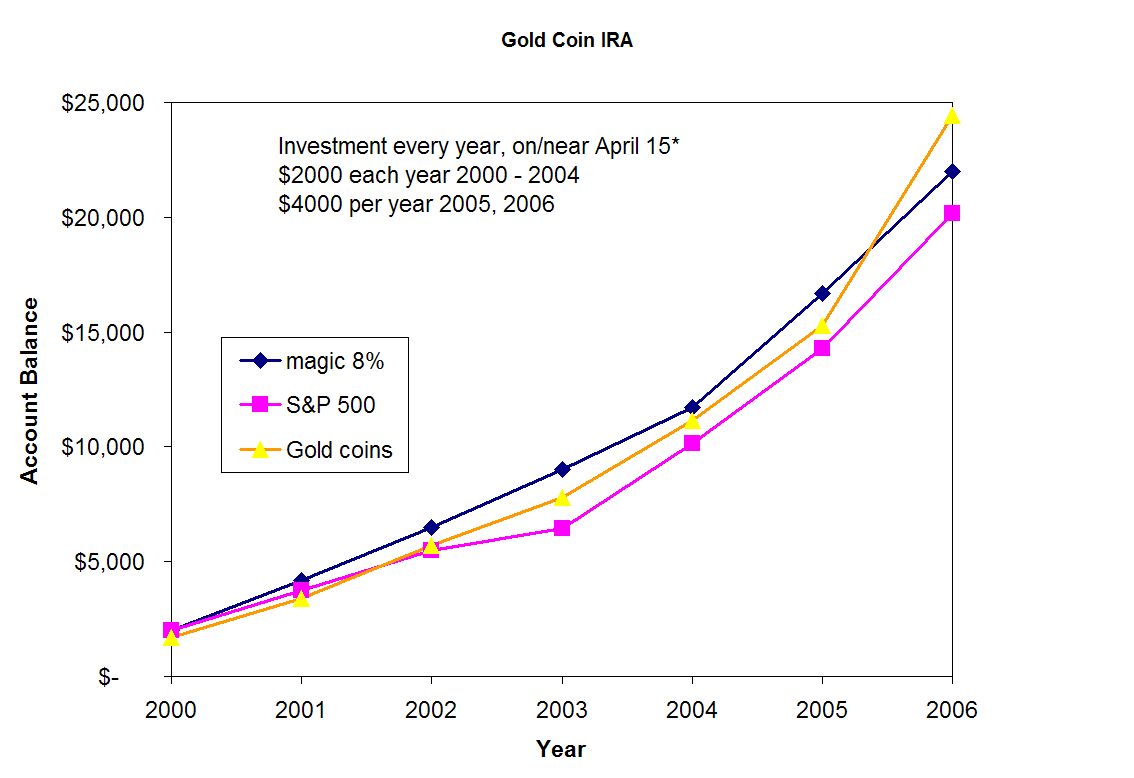

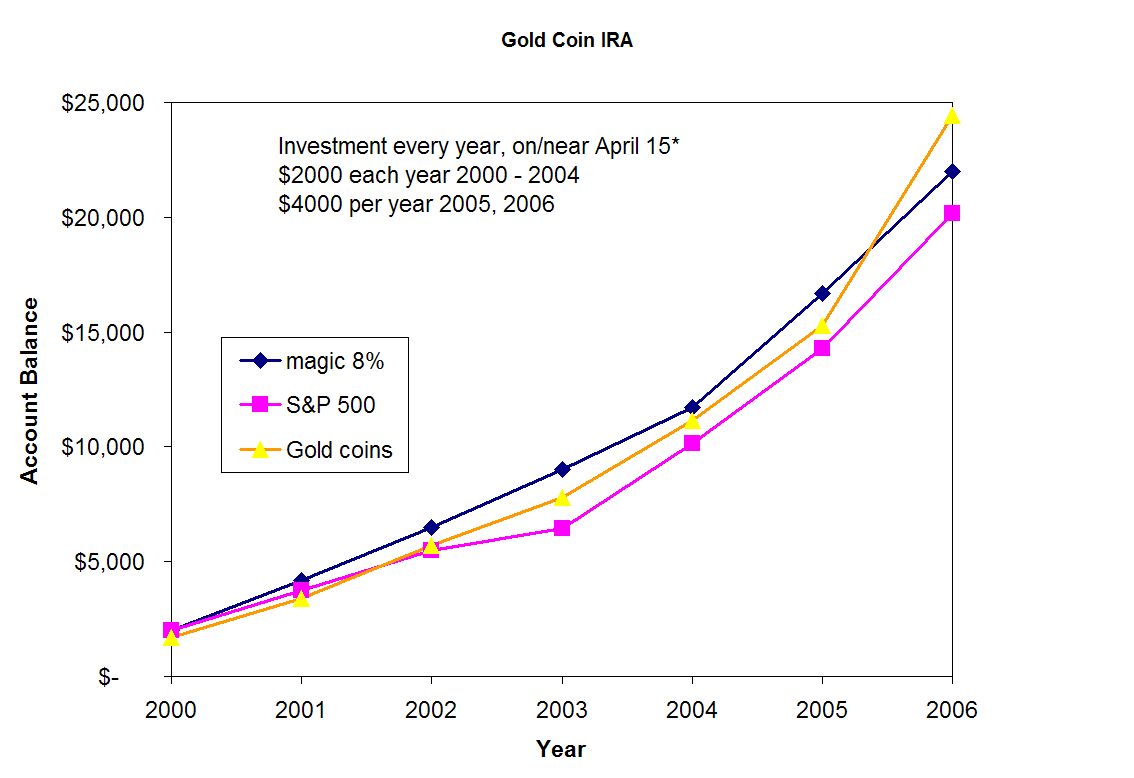

It's not only easier, more flexible, and more private, but the REAL IRA has been outperforming the alternatives! * It's been better than the S&P 500 for a long time, and lately its outperformed the "magic 8%" portfolio. Better still, these results assume over $1,600 less investment in the REAL IRA.

*Past performance is not indicative of future returns. This is not financial advice. You, and you alone, are responsible for your REAL IRA.

For details on the how the chart was prepared, read on:

The chart assumes that you save the maximum amount on or near April 15 every year (except 2006, I've used March 31 prices), and that you haven't reached the golden age of 50, when our masters decree you are allowed to save some more. The limits are $2,000 for the years 2000-2004, and $4,000 for 2005 and 2006. (Of course, in the REAL IRA there are no limits)

The "Magic 8%" results come from simplistic assumptions regarding compounding. Retirement fund literature is full of this stuff. Note that none of the fund sellers can tell you WHERE to put your money to get this lovely 8% return, they just assume you'll know what to do. I never did.

The "S&P 500" fund assumes you invest in an index fund that tracks the S&P 500.

The "Gold Coins" investment is a little more complicated to calculate, but a lot simpler to actually make. I took the spot price of gold on or near April 15, then added a 5% premium for bullion coins. This gives an honest price for the coins, and people like The Camino Company will sell American Eagles for less than 5% over spot, and Krugerrands for only 3% added.

I calculated how many coins one could buy for less than $2000 (or $4000). In a typical year I bought 6 coins, not 6.3 coins. In other words, the investment was less than $2,000. Then I added $25 shipping. Because of not saving exactly $2000 every year, the total investment in gold coins, including the premiums and shipping, was less: $16,367 for gold coins versus $18,000 for the fedgov IRA plan. That means you have $1,633 extra in your pocket to spend on yummy tacos, cold beer, medicinal herbs, firearms, or whatever else you like.

But the REAL IRA is still the best performer. As the chart shows, it has outperformed even the optimistic 8% assumption last year. What the chart doesn't show is the peace of mind and lack of hassle involved in owning real wealth. The benefits of escaping the mass consensual hallucination that we call money are literally incalculable.

Posted by Silver @ 10:13 AM CST

Link